A new year is upon us and it is time to bring out the crystal ball and predict what exactly will happen this year and how we can make loads of money. Aah, if only it were that simple.

The real challenge in many ways is not the lack of information as you will see by reading the last bit of this article, there are many opinions out there. Diverging perspectives and differing views further add to the challenge of not knowing what exactly to do with your hard earned cash.

It is worth noting these views are broad and may not apply to every type of investor at the same time.

The main thing here is to think about the Event, Opportunity and Asset class that will allow you to benefit from what happens during the year. As always, we are not providing financial advice in anyway so do seek expert advice – and share some of it with us.

In this article we share details of the trends that will take focus this year and any possible opportunities this will create.

China

There are several aspects of this so we will break it down.

New Covid Variants

In the last few weeks of 2022 reports came to light that the Chinese authorities have been dealing with a surge in covid cases. Initially, the government had a zero covid policy which led to large swathes of the populations in cities to be locked down with strict rules applied.

Well, that did not go according to plan and the impact to the economy could not be ignored. Protests occurred in a number of cities too. The authorities have since relaxed these rules however, covid cases are rising rapidly and a number of countries have taken steps to check inbound flights from China for negative Covid results.

Prior to these checks being introduced, it is very likely that passengers from China coming into Europe and other parts of the world, may well have been infected with this new strain of Covid.

Is this cause for alarm? The actual details are beyond the scope of this article because there are many factors to consider and it can get messy.

Main takeaway here is that the world may be dealing with a cocktail of covid variants and depending on the impact it has and what governments choose to do, there will be impact (on the Economy and Businesses) that range from little to severe.

On the severe side of things, a lockdown will ensue across the board, flights will be cancelled and we could see a 2020 playbook where demand for oil slumps, airline and hospitality sectors suffer, biotech stocks gaining more ground and ‘covid stocks’ such as Netflix, Disney, Zoom, Peloton and any other may see growth in their share prices – but this is an extreme example.

What is more likely to happen is that the situation is closely monitored and if the impact to the healthcare infrastructure increases, then action will be taken accordingly that may result in some temporary lockdowns and travel restrictions.

Countries are increasingly imposing stricter travel requirements on passengers from China and this is only set to ‘get worse’ as Covid cases rise across different countries.

Sectors and companies to watch here include airline, biotech, hospitality and travel. A simple google search can reveal these sectors and stocks. ETFs are also worth considering in this case.

Increased Demand for Resources

China’s end of the zero covid policy in may ways meant the Chinese economy is open without any interruptions for business and this is positive news (barring the issue with an explosion of covid cases) from an economic standpoint since it means demand for commodities, metals and other resources China is a major consumer of, increases.

As a side note, the Chinese government has put money aside to bail out troubled real estate companies which is also a positive sign as this will settle nerves and renew interests in that market especially since the Evergrande and the contagion from it.

These are some of the Chinese ETFs to watch; the opportunities will be more apparent as the year transpires.

Chinese Companies Listed on US Exchanges

The 200 plus Chinese companies that would have been removed from the US Stock Exchange, will no longer be removed since US Auditors have been granted access to the books of these companies and have not found any issues.

This decision marks an important turning point and an end to the longstanding conflict between Beijing and Washington. There are a number of guidelines and rules a company will need to adhere to in order to be listed in the US.

Increased confidence in these companies from an audit stand point of view is positive news since many buy side clients and other investors that would otherwise be hesitant to invest, will consider doing so.

Companies such as Baidu, Alibaba and other blue chip Chinese companies listed in the US would have been impacted by this. There is potential upside for increased demand in these companies shares.

These are the Chinese companies listed in the US can be found here and there are a number of ETFs that have exposure to these companies. ETFs are good as they provide diversification and are low cost.

Geopolitical Issues

Unless you have lived under a rock (which to be fair, may be a safe place considering what is going on in the world right now), you will be aware of the main conflict in Europe.

The ongoing conflict in Ukraine and Russia means we are paying even more for energy and some soft commodities. While this conflict is not entirely to blame for the inflation in these goods, it is a factor that cannot be ignored.

One potential opportunity from this is that more investments will pour into renewable and other sources of energy in an attempt to wean us off from Russian gas. These developments are still in the early stage but it is an area to closely watch.

We are going to be paying more for energy regardless of what happens. This conflict will last longer than experts may come to expect (we are dealing with egos and hidden agendas after all) and while this continues as we have seen, energy companies have made a killing in their profits.

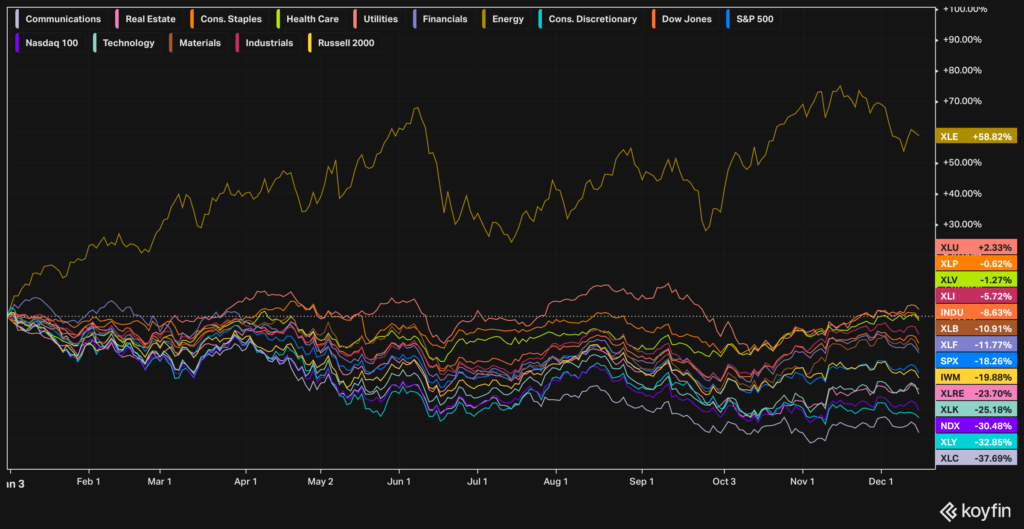

As I alluded to earlier, this was not all due to the conflict in Ukraine; as we can see, energy prices have been going up since 2021. This graph shows the Sectors and ETFs that are in the Energy Sector and you can see the performance.

Looking closer at the constituents of the ETFs, you can see individual companies and see how many of them have increased dividends due to how much money they have made.

Blue chip energy stocks with big balance sheets can navigate this energy crisis and benefit from it. Definitely a good idea to watch them closer.

There are other potential geopolitical flashpoint such as China and Taiwan and the decoupling of these economies, North Korea testing even more missiles and Japan investing more in its military. Europe is closest to home and the impact of the conflict is felt more readily hence our focus on it.

Cost of Living Crisis

One pain point from this conflict is the cost of living and how we are paying more to heat our homes and businesses. Now some people have argued energy companies are opportunistic in their pricing and using the conflict as a reason to hike prices.

Whatever the case may be, the prospect and reality of spending a larger portion of your pay check on staying warm and just being able to live is something the population is struggling to understand and the strikes we have seen in the UK with the different Unions is a reflection of this frustrations.

Inflation

We have written a bit about inflation and how it affects us. Sadly enough inflation is not going away any time soon and while this persists, the Central Banks will continue to do what they can to bring it under control without crashing the economy – some would argue we are already seeing a slow down that will get worse.

The question on peoples minds here is if inflation has peaked. Some experts suggest this will be in cycles so as far as this cycle is concerned, we are seeing inflation peak. It is important to understand how inflation is measured to see what items influence the calculation.

As we exist winter, there is (should be) lower demand for energy and this has the effect of reducing inflation from energy. Gas companies may choose to obtain more gas and shore up their storage in the meantime.

Getting into winter 2023, we may well see inflation from energy rise and a new cycle return.

The monetary policy of the Central Banks post covid contributed is a factor in causing inflation in many ways since the availability of easy money meant investors were borrowing hands over fist and buying whatever they pleased (including Cryptocurrencies and NFTs).

Now, money printers no longer goes ‘brrrrrr’ (check the meme) as Central Banks have increased interest rates in an attempt to combat inflation – so far it appears to be working. A reversal or change in the central bank policy has the aim of reducing inflation and there are promising results but the main danger is not to crash the economy in the process.

Recessions Fears

Muttering and whispers of a recession have been around since he last quarter of 2022 and these whispers have grown louder. Looking at the economic numbers it is hard to debate that we are in a recession in the UK, in Europe and many major economies.

The IMF has revised its growth forecast for world economic growth. There are opportunities to invest in the right type of companies and the right companies in this economic climate are those that are:

- Cheap: Trading at a discount to their value. There are metrics such as PE and other ratios that can reveal this. Here is a quick breakdown of some of the ratios.

- Staple and Consumer Groups: There are companies in this sectors we cannot do without recession or not.

- Large Balance Sheets: Companies that are large enough to weather the economic storm of inflation and recession. Just bear in mind no there are unforeseen events that can potentially impact these companies.

Artificial Intelligence: The Rise of the Machines – Again

ChatGpt3 by OpenAI is a game changer in the making and the recent developments they have made is cause for excitement.

Artificial Intelligence is set to replace many jobs and while it may not be apparent which jobs will cease to exist, the opportunity is there to invest in the future.

The thought process here is to look for companies that fit one or more of these criteria:

- Companies that invest in Open AI directly or partnering with them. Microsoft is a candidate for that.

- Companies that are using the technology to further reduce costs and streamline operations or create more innovative solutions.

- Startups that are heavily use A.I to create innovative products and capture market share.

Any companies that fit that profile are potentially good candidates to look further into and invest in, all other things considered.

Final Words and Input from the Real Experts

2023 is expected to be a challenging year in many ways carrying on from what we have seen in 2022 but there are opportunities. These opportunities may not be apparent at the beginning of the year and will require investors to look closer to find value and to be dynamic in their approach.

This suggests simply putting your money in a passive fund may not give you superior returns – just a thought.

As Warren B says, it is only when the tide goes out we can see who has been swimming naked (yikes). Challenges present a chance to grow and that is how we see 2023.

Side note, India has overtaken the UK (go India!) in GDP terms and is looking promising going into the year. India is one country to watch in the coming years and there are a number of ETFs that are India-focused should you look to benefit from the potential growth of the Indian economy.

Another honourable mention is Cryptocurrencies and at this stage it seems like there is drama each year (sigh). The latest and ongoing FTX Scandal for lack of a better word has shown and continues to reveal what can happen without due diligence or regulatory framework.

The price of Bitcoin and the other cryptocurrencies have slumped in the last 12 months and may have hit a bottom but it is unclear.

Two things we see coming out of this is that if some sort of regulatory framework is put together to protect investors in Cryptocurrencies, that can renew investor confidence.

Investors can also focus on other applications of the Blockchain and not merely cryptocurrencies. The Blockchain technology is useful and has a lot more application so rather than focus on only one aspect of it (cryptos), perhaps it is better to find other applications of this technology and seek ways to benefit from it.

Expert’s 2023 Forecast

Some of the heavy hitters in the industry with their army of research analysts have put their thoughts on the coming year and I have put them together for your reading pleasure.

Worth remembering some of these experts did not foresee the impact of covid, high inflation and the Russian-Ukrainian conflict. So read what they say but decide for yourself.

In no particular order, here they are. Happy reading and all the best in the new year.

Goldman Sachs: https://www.goldmansachs.com/insights/pages/gs-research/macro-outlook-2023-this-cycle-is-different/report.pdf

J.P Morgan: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/mi-investment-outlook-ce-en.pdf

Morgan Stanley: https://www.morganstanley.com/im/publication/insights/articles/article_2023investmentoutlook_enin.pdf

Bank of America: https://about.bankofamerica.com/en/making-an-impact/outlook-2023-webcast

Schroders: https://www.schroders.com/en/insights/economics/outlook-2023-cio-and-multi-asset-its-all-about-valuations/

Blackrock: https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-2023.pdf

Societe Generale: https://insight-public.sgmarkets.com/insights/multi-asset-portfolio-outlook-2023

Allianz: https://www.allianz.com/en/economic_research/publications/specials_fmo/global-economy-outlook.html

HSBC: https://www.privatebanking.hsbc.com/content/dam/privatebanking/gpb/wealth-insights/investment-insights/house-views/2023/brochure/Q1%202023%20Investment%20Outlook%20-%20Looking%20for%20the%20Silver%20Lining%20-%20Brochure.pdf

Barclays: https://www.cib.barclays/our-insights/3-point-perspective/q1-2023-global-outlook.html#:~:text=2023%20may%20well%20be%20one,3.2%25%20growth%20expected%20for%202022

Natwest: https://www.natwest.com/corporates/insights/markets/the-year-ahead-2023.html

Citigroup: https://www.privatebank.citibank.com/newcpb-media/media/documents/outlook/outlookwealthreport2023.pdf

UBS: https://www.ubs.com/global/en/assetmanagement/insights/investment-outlook/panorama/panorama-end-year-2022/articles/calm-waters.html

Franklin Templeton: https://www.franklintempleton.lu/articles/brandywine-global/outlook-for-2023-complicated-fragmented-macro-road-map

TSLombard: https://blogs.tslombard.com/things-that-wont-happen-in-2023

PGIM: https://www.pgim.com/investments/getpidoc?file=DF1B2252A93C42328E3C0AF5BC12455E

Nordea: https://docs.nordeamarkets.com/nordea-economic-outlook/economic-outlook-2022/eo-en-03-2022/

Capital Group: https://www.capitalgroup.com/advisor/insights/categories/outlook.html

Vanguard: https://investor.vanguard.com/investor-resources-education/news/vanguard-economic-and-market-outlook-for-2023-global-summary

S&P Global: https://www.spglobal.com/ratings/en/research-insights/topics/outlook-2023

Moodys: https://www.moodys.com/newsandevents/topics/2023-Outlooks-00705F

AXA Investment Managers: https://www.axa-im.com/investment-institute/outlook-2023

Invesco: https://www.invesco.com/middle-east/en/insights/investment-outlooks.html

Macquarie: https://www.macquarie.com/us/en/about/company/macquarie-asset-management/outlook-2023.html?creative=637442313013&keyword=economic+outlook&matchtype=b&network=g&device=c&adgroupid=150691169984#:~:text=Download%20the%20magazine%20(PDF)

Amundi: https://www.amundi.com/usinvestors/Local-Content/News/Investment-Outlook-2023-Some-Light-for-Investors-After-the-Storm

DWS: https://www.dws.com/en-es/our-profile/media/media-releases/dws-market-outlook-2023/

T.Rowe Price: https://www.troweprice.com/financial-intermediary/uk/en/lp/global-market-outlook.html

Lazard: https://www.lazardassetmanagement.com/uk/en_uk

Fidelity: https://professionals.fidelity.co.uk/static/master/media/pdf/outlook/annual_outlook_2023.pdf

BNY Mellon: https://www.bnymellonwealth.com/content/dam/bnymellonwealth/pdf-library/articles/Final_BNYM2023OutlookMaster12_20_22.pdf

Wells Fargo: https://www08.wellsfargomedia.com/assets/pdf/personal/investing/investment-institute/2023-outlook-report_ADA.pdf

State Street: https://www.ssga.com/library-content/pdfs/gmo-2023-navigating-a-bumpy-landing.pdf

ING: https://think.ing.com/uploads/reports/ING_global_outlook_2023_Dec_2022_OT.pdf

Deutsche: https://www.deutschewealth.com/content/dam/deutschewealth/cio-perspectives/cio-insights-assets/q1-2023/CIO-Insights-Outlook-2023-Resilience-versus-recession.pdf